Targeted areas of the state) with a mortgage credit certificate. As for variable rates, the 5/1 arm rate currently stands at 4.56%.

6 Options For First Time Home Buyers In South Dakota 2021 Benzinga

The total mcc tax credit for each year cannot exceed the recipient’s total federal income tax liability for that

South dakota first time homebuyer tax credit. Sdhda's tax credit (mcc) sdhda's tax credit is available through a mortgage credit certificate (mcc), which reduces the amount of federal income tax you pay, giving you more disposable income. That link takes you to a list of. Created by the internal revenue code of 1986, the housing tax credit program offers a reduction in tax liability to owners, subject to restrictions.

The mcc tax credit remains in place for the life of the mortgage, so long as the residence remains the borrower’s principal residence. 3% or 4% of the purchase price of the home, forgiven at 20% per year for 5 years. Hapi down payment closing cost assistance.

You may be eligible for a south dakota mortgage if you: Today’s rates for first time homebuyers in south dakota. Your fee is reduced to $250.

(hapi) acknowledges that potential homebuyers able to make the monthly payments on a new home may not have enough saved for a down payment. The bill also made more homeowners eligible to claim the credit on their taxes. Mortgage rates are at 3.00% for the 30 year fixed loan program and at 2.56% for the 15 year fixed.

Mortgage interest has been tax deductible for some time, but this mcc credit is different. The first time homebuyer program is currently suspended with no funds available for first mortgages or down payment assistance. The firsthomes tax credit is a great option to help new homebuyers save money.

This agency delivers a variety of homebuyer assistance programs throughout the state. South dakota’s homes are possible inc. Check out fha and va rates as well if you are doing low or no down payments.

To qualify, you must meet gross household income limits based on county. The south dakota housing development authority, sdhda, is a state housing finance agency for south dakota. Must be repaid upon sale, transfer, refinance, retirement of the first mortgage or owner vacancy.

If a homebuyer owned and lived in a dwelling unit that was not permanently affixed to a permanent foundation (ie; A mobile home), it doesn't count as previous homeownership. The property you’re considering can’t exceed the current purchase price maximum of $250,200.

For homes purchased on or before december 31, 2011. Mum tax credit that may be taken for any given year at $2,000 for each mcc recipient. Ask your lender about our.

The credit is the smaller of: The program enables lenders, individuals, partnerships, corporations, and other entities (herein referred to as the “bond purchaser.

First-time Homebuyer Programs In Ohio 2021

1st Time Home Buyers Real Estate Realty Home

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Rates Mortgage Interest

2

South Dakota First Time Home Buyer Programs

South Dakota Sd First Time Home Buyer Programs For 2019 - Smartasset

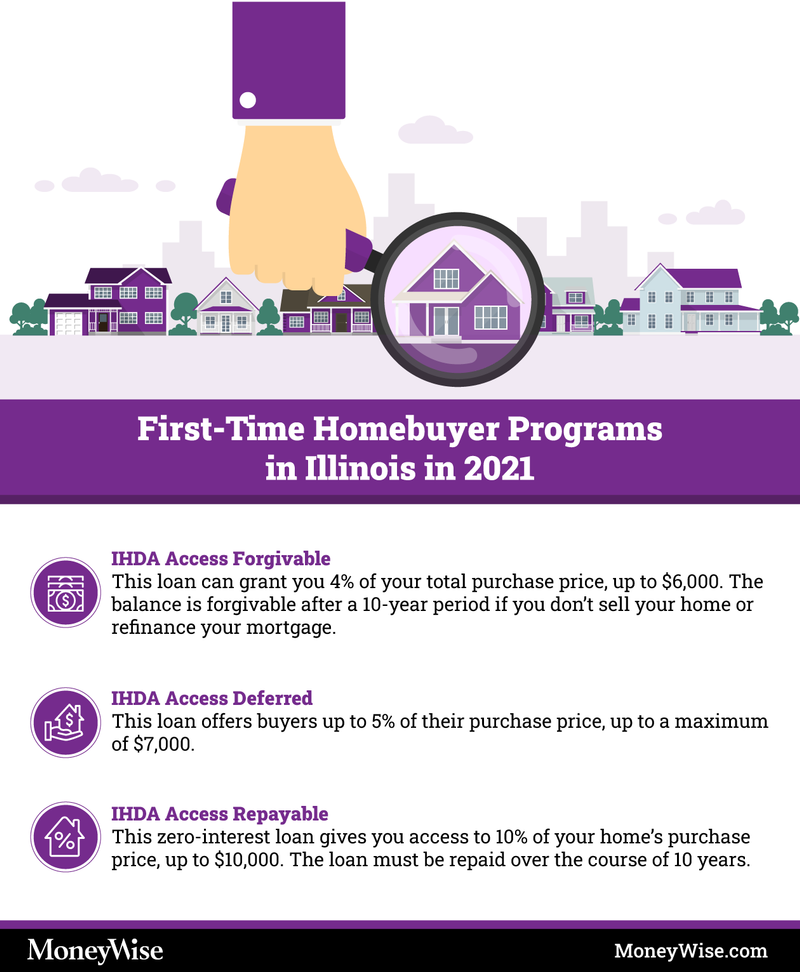

First-time Homebuyer Programs In Illinois 2021

South Dakota Sd First Time Home Buyer Programs For 2019 - Smartasset

Pin On Home Selling And Buying

Your Questions About South Dakotas Plains Commerce Bank

How To Start A Real Estate Business Infographic Real Estate Infographic Business Infographic Real Estate Business

Programs For First-time Home-buyers In South Dakota

Home Buying Mistakes To Avoid Home Buying Preapproval Mistakes

Sdhda Announces New Options For First-time And Repeat Homebuyers Ncsha

Programs For First-time Home-buyers In South Dakota

Make Or Break Your Home Appraisal Whether Youre Looking To Sell Your Apartment Or Refinance At A Lower Rate Your Appra Home Appraisal Appraisal Savings Bank

First-time Homebuyer Programs In South Dakota - Newhomesource

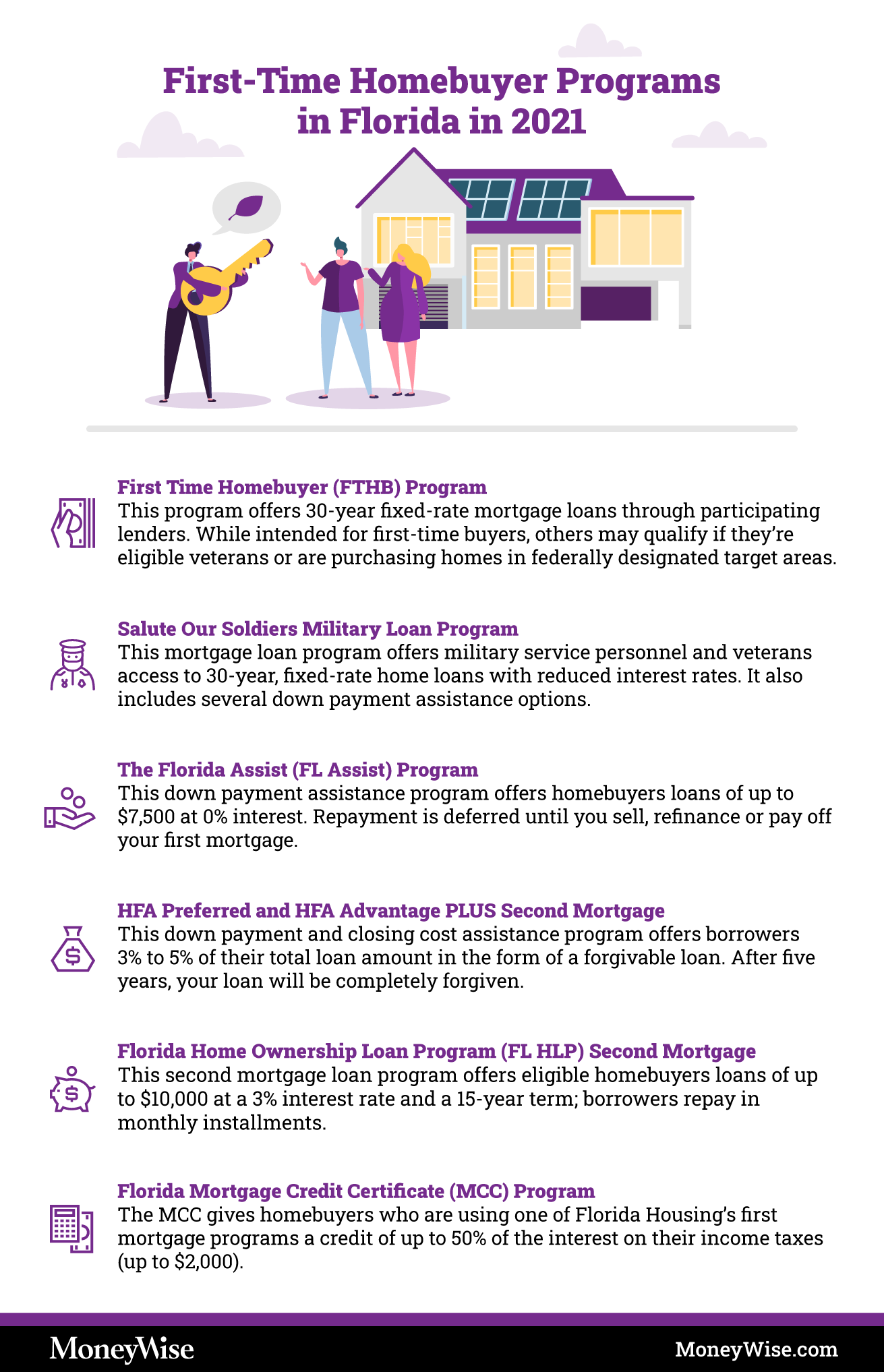

First-time Homebuyer Programs In Florida 2021

South Dakota First-time Homebuyer Assistance Programs Bankrate