The program allowed the family to find a home that was the right fit and allowed the small community to welcome a new family. Affordable interest rates, in combination with additional incentives offered by mhdc, allow prospective buyers to obtain mortgage financing in a competitive market.

When Getting Pre-approved For A Home Loan See If You Are Eligible For Different Loan Programs Not Just Th In 2020 Conventional Loan First Time Home Buyers Home Loans

Luckily, thousands of homebuyer programs exist to help people do just that.

First time home buyer grant kansas city mo. It's a down payment assistance program through enterprise bank & trust and ches, inc. (funding is not provided directly by the city of independence, mo) The rate will remain the same the entire life of the loan.

The program is called welcome home kansas city. As for variable rates, the 5/1 arm rate currently stands at 4.56%. Today’s rates for first time homebuyers in missouri.

The new program provides a grant to help new homeowners with. Visit the mhdc website for addtional information. Mhdc provides a grant for the down payment assistance, up to 4%, of the final mortgage amount for the down payment and the closing costs.

Mortgage rates are at 3.00% for the 30 year fixed loan program and at 2.56% for the 15 year fixed. Select your county from the list below, and contact a local lender to start the process. First federal bank of kansas city.

Missouri buyers, mdhc loan, mhdc grant, first time buyer, home loan, home buyer, zero down payment, odessa missouri home, oak grove missouri homes, grain valley missouri homes, blue springs, independence, lees summit, kansas city, liberty. Check out fha and va rates as well if you are doing low or no down payments. Exceptions to this rule are “displaced homemakers” and “single parents.

Must be a first time home buyer. Meet with a mortgage broker and find out how much you can afford to pay for a home. The first time homebuyer program is the sole offering of kansas housing, yet the benefits are robust:

Their annual household income must not exceed 80% of the area median income (limits shown below) and buyers must provide a minimum of $500 from their own funds toward the purchase. The first step is to find a khrc first time homebuyer lender serving your area. Independence first time home buyer program.

Use this down payment tool to find out if there is a program that is right for you. As with all mhdc loans, the mortgages are for 30 years. Community mortgage, llc (nmls #224143) 19045 e valley view pkwy;

View all allen anderson atchison barber… When you’re ready to buy a home, coming up with a down payment can be one of the biggest hurdles. Meet with a mortgage broker and find out how much you can afford to pay for a home.

With stories like this one, the first time homebuyer program is helping support the state’s rural revitalization initiatives while helping deserving families find the safe, affordable housing they need.

First-time Homebuyer Programs In Ohio 2021

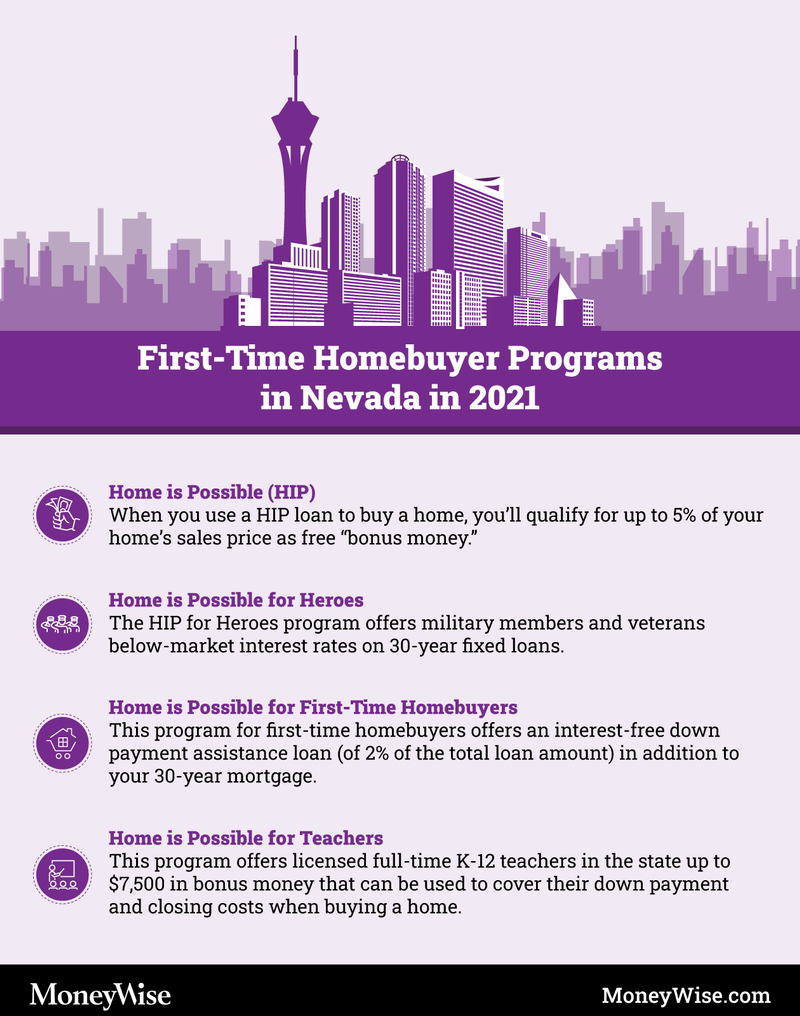

First-time Homebuyer Programs In Nevada 2021

Nebraska First-time Homebuyer Assistance Programs Bankrate

Missouri First-time Home Buyer Programs Of 2021 - Nerdwallet

2021 First Time Home Buyer Programs - Usda Mortgage Source

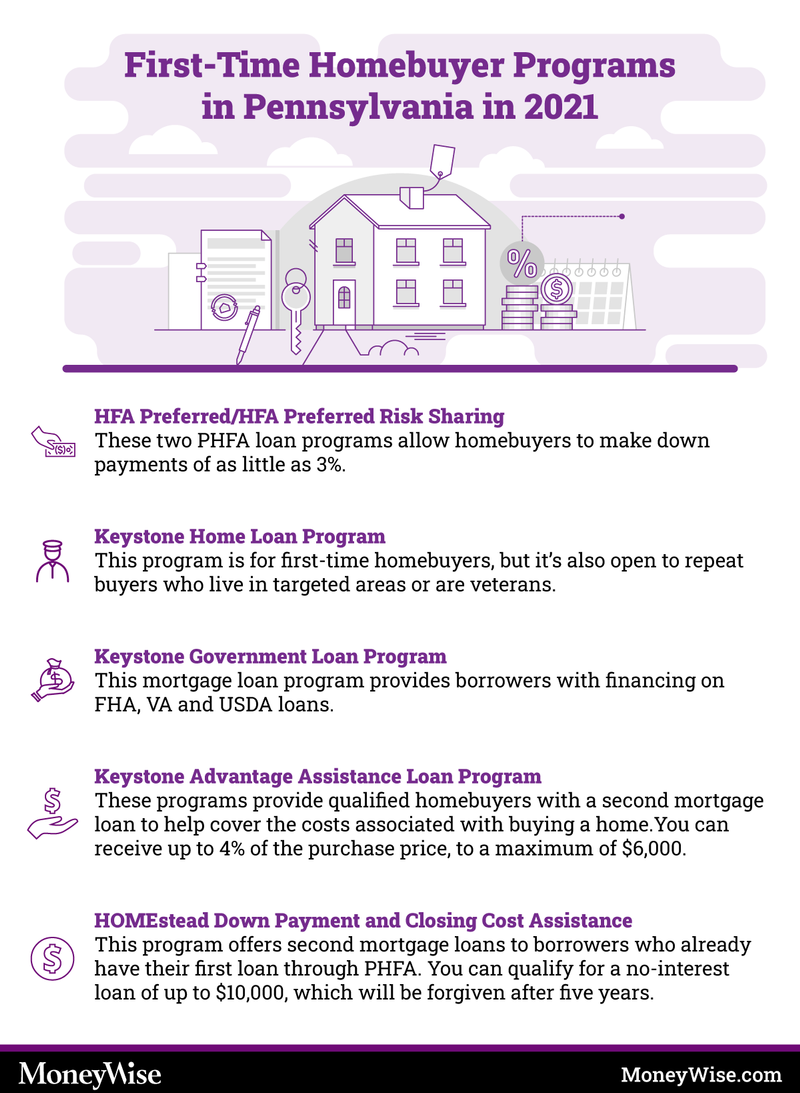

First-time Homebuyer Programs In Pennsylvania Pa 2021

First-time Home Buyer Seminar - Members Cooperative Credit Union

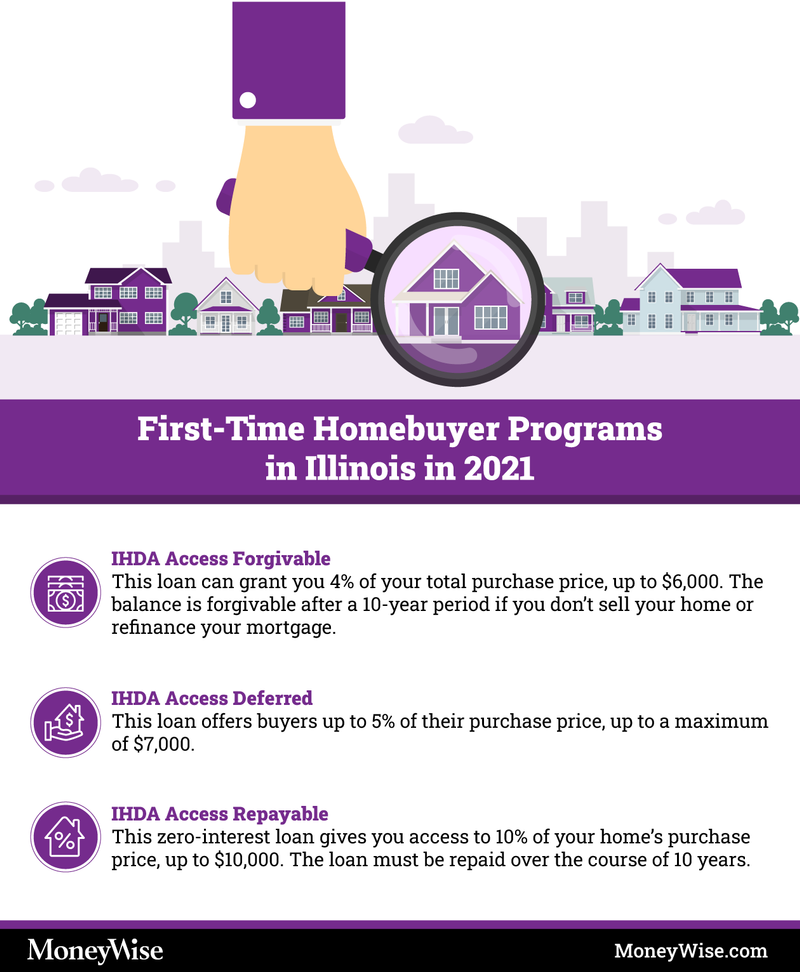

First-time Homebuyer Programs In Illinois 2021

First Time Homebuyer Grants And Programs Nextadvisor With Time

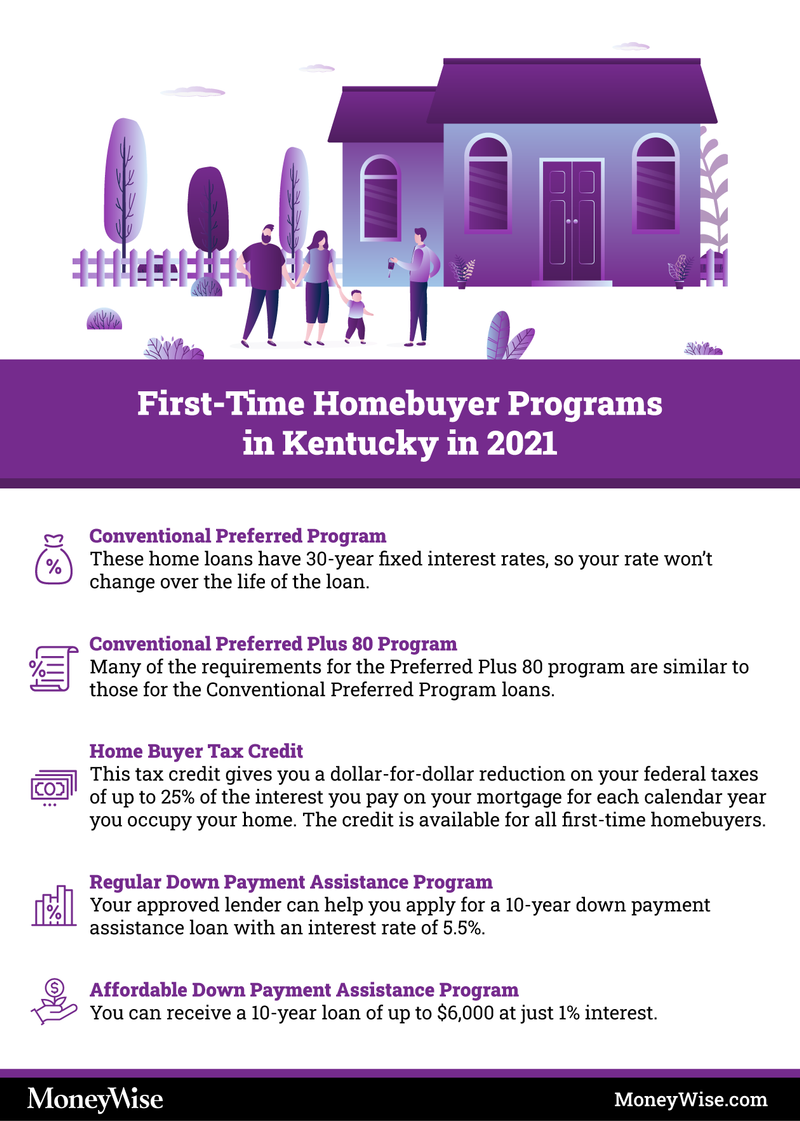

First-time Homebuyer Programs In Kentucky 2021

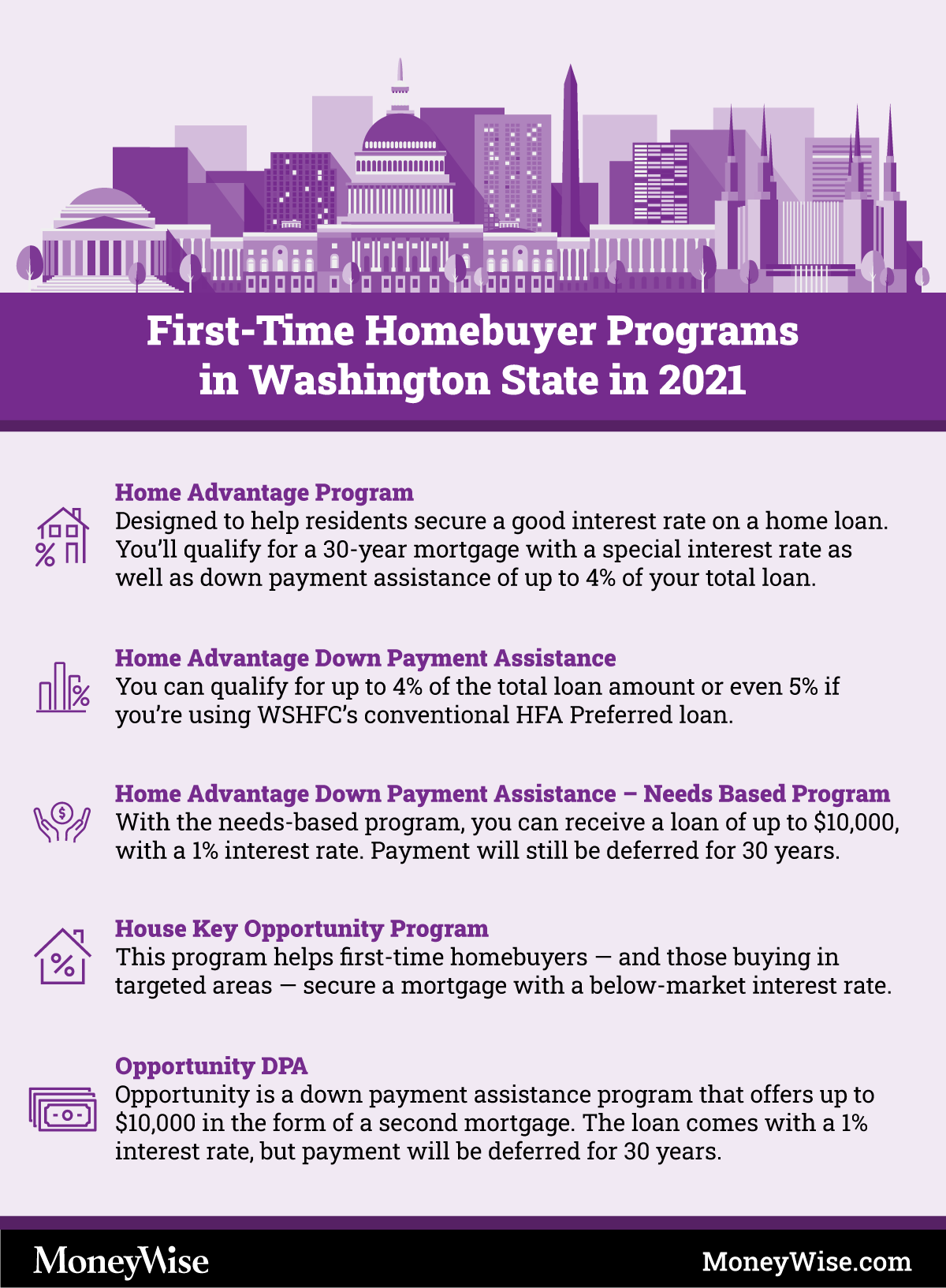

First-time Homebuyer Programs In Washington State 2021

First-time Home Buyer Helping Make Your First Home Loan Easy Nasb

Missouri Mo First-time Home Buyer Programs For 2019 - Smartasset

First Time Home Buyer - Grants And Grant Programs

First Time Home Buyer Programs In All 50 States Mortgage Rates Mortgage News And Strategy The Mortgage Reports

First-time Homebuyer Programs In Missouri - Newhomesource

First-time Homebuyers Guide Dash Home Loans

First-time Home Buyer Seminar - Members Cooperative Credit Union

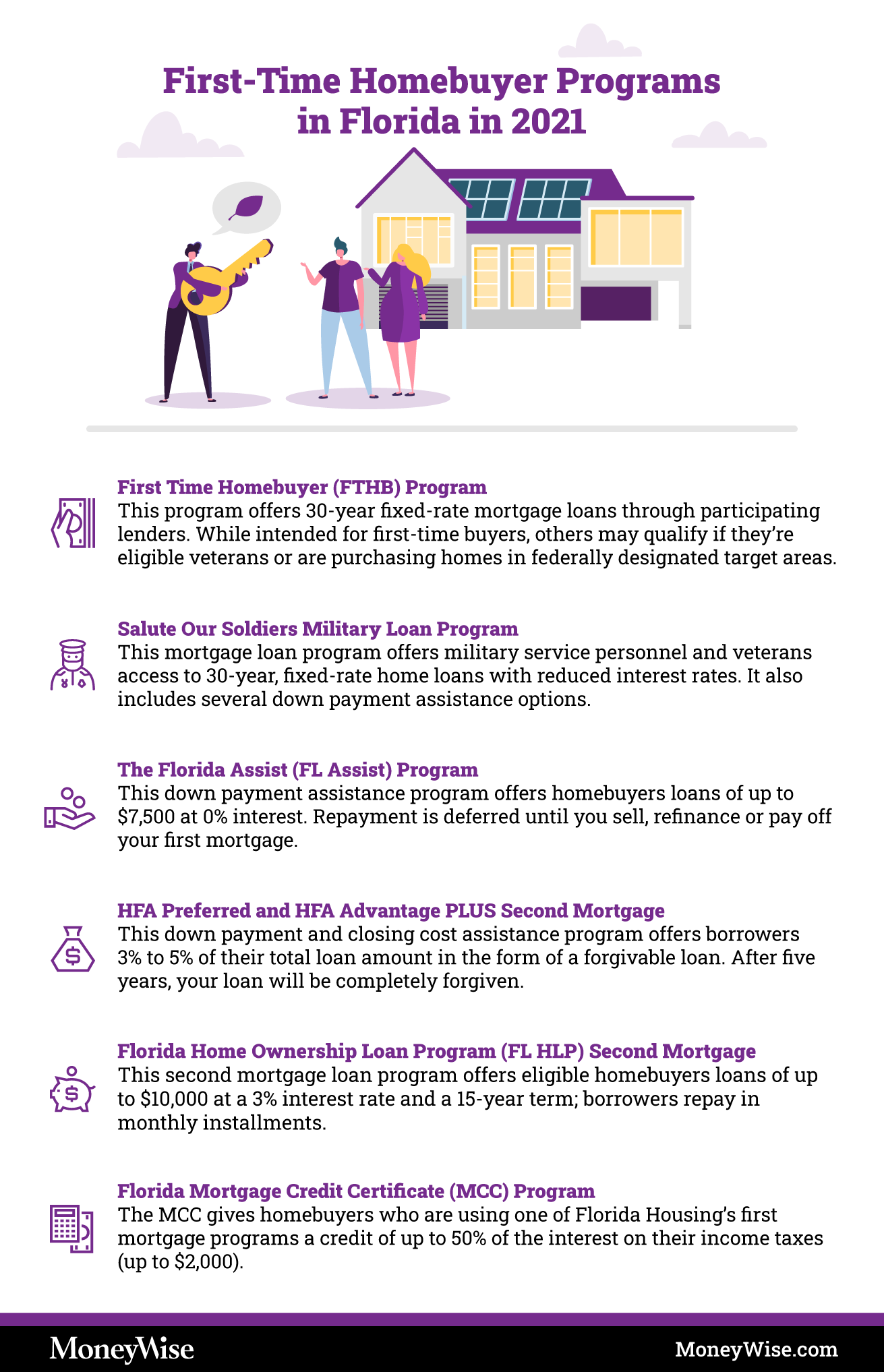

First-time Homebuyer Programs In Florida 2021