What’s more, there are no principal payments required on this portion. I apologize for the length but these are things i wish i knew before buying my own first home.

First Time Home Buyer Rrsp In Canada Using Your Rrsp Money

Posted by 21 hours ago.

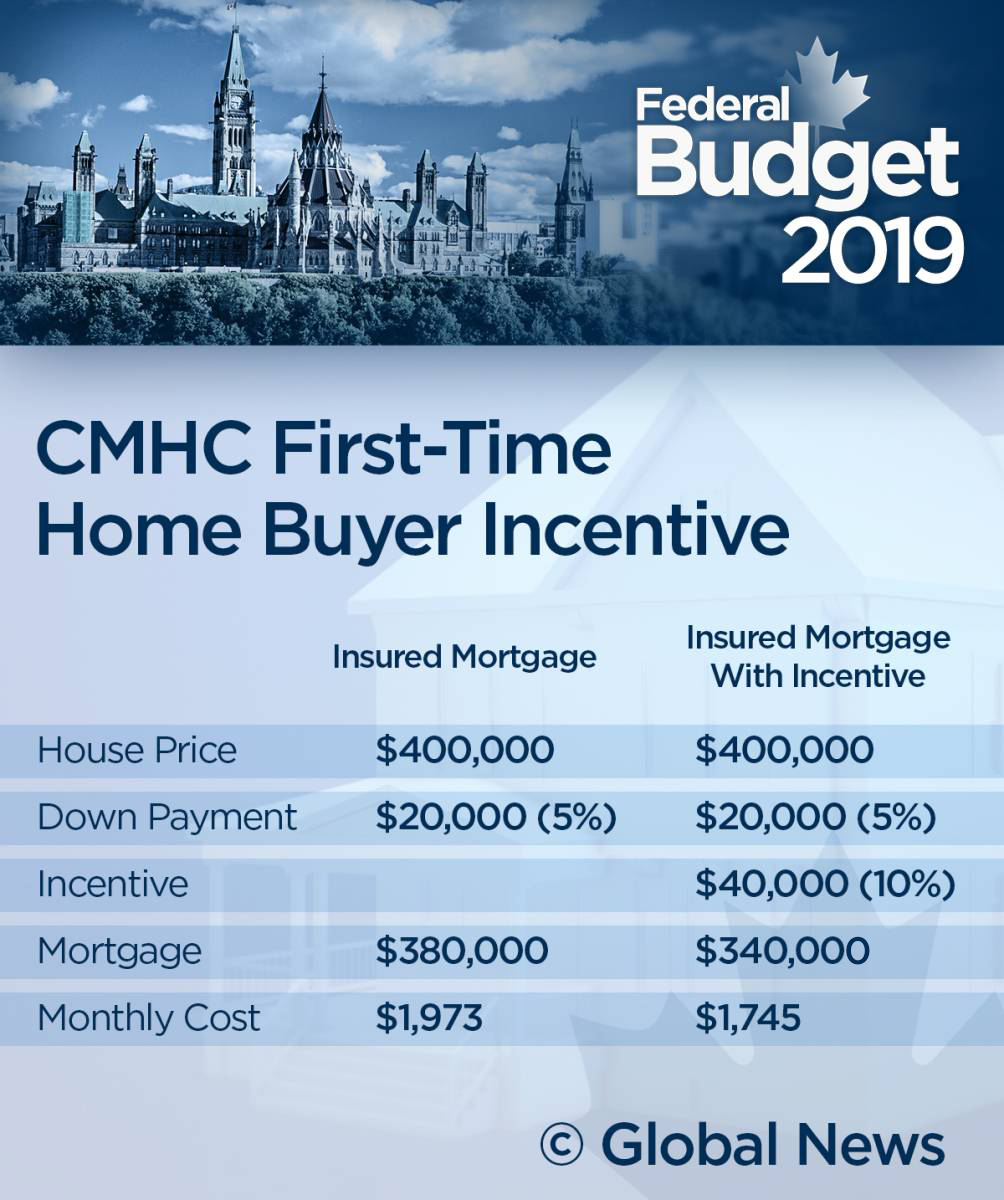

Reddit first time home buyer canada. If you are putting down less than 20%, you can find the mortgage affordability rules as set out by the cmhc here.in my experience, mortgage advisers basically have the. If the average household income is $70k, the buyer can get ~4.5x that in a mortgage without the incentive ($315k), but only 4x that with the incentive ($280k). But with the mortgage limitation with the incentive, the amount of mortgage they can take is lower if they take the incentive.

For homes valued at $1 million or more, the minimum down payment is 20%. I am looking for some advice for purchasing a new home potentially in the fall (alberta). You can also repay it at any time without a prepayment.

Learn more on how to participate in the home buyers’ plan. Whether you are a first time home buyer or buying your next home, selecting the right financing for your home is of major importance. Changes to first time home buyer plans in canada.

Log in or sign up to leave a comment. For homes between $500,000 and $1 million, you’ll need 5% of the first $500,000 and 10% of the rest of the price. In canada, you need to put down at least 5% of the home purchase price as a down payment.

While the incentive matches your 5% down payment. You do have to pay it back of course but the process is. The first step towards buying a house is to save for a down payment.

Going into the process, our realtor warned us that. A credit score of at least 620 is. 5% of the purchase price of an existing home;

At the present time, there are two incentives for first time home buyers to take advantage of. In today’s market, there are many different lenders and products for you to choose from, and on top of that, the lending rules and regulations are constantly changing. We've been saving for a very very long time, fingers crossed we make it to the closing table.

A participant’s insured mortgage and the incentive amount cannot be greater than four times the participant’s qualified annual income. Get your free credit score. Lastly, as a home buyer you will need a lawyer or notary who is working on your behalf as well and who can help you with those tough decisions.

Know where you stand before reaching out to a lender. This addition to your down payment lowers your mortgage carrying costs, making homeownership more affordable. If you qualify for the program, you may be eligible for either a full or partial exemption from the tax.

These are three areas that will make a great start for a successful first. This incentive offers 5% or 10% of your home's purchase price to put towards a down payment. 5% or 10% of the purchase price of a newly constructed home;

I currently have approximately 50k in my tfsa and 40k in my rrsp and in the last calendar year they made 9% and 5% respectively. Always have your contract reviewed by the lawyer so they can point out problems with dates, subjects etc. Spouse and i buying a home, conventional mortgage with 20% down.

Do your own math on what you can and cannot afford before meeting the mortgage advisor. You need to repay the incentive after 25 years, or when you sell the property. The program offers 5 or 10% of the home’s purchase price to put toward a down payment.

Changes to first time home buyer plans in canada. Need some advice for a first time home buyer! We have been offered an unexpected one time gift by family towards the downpayment.

My partner and i finally have decent jobs in our respective fields after years of schooling. Help reddit coins reddit premium reddit gifts. I am a contractor and have some decisions to make financially when purchasing.

Not sure if there is any new info for most. For example, if in 2016 you sold the home you lived in before, you may be able to participate in 2021 or if you sold the home in 2017, you may be able to participate in 2022. How to get preapproved for a home loan.

If one or more of the purchasers don’t qualify, only the percentage of interest that the first time home buyer(s) have in the property is eligible. The first time home buyers' program reduces or eliminates the amount of property transfer tax you pay when you purchase your first home.

Df11zpyu6a1nkm

Top 5 Tips To Keep In Mind When Buying A Home Home Buying Home Buying Tips Emoji Guide

Buying Your First Home 8 Ways To Be Prepared Forbes Advisor

If You Like To Work In An Advertising Office You Need To Convince Your Employer By Writing A Good Advertising Resume The Most Important Thing When Y Check

First Time Homebuyer Grants And Programs Nextadvisor With Time

Nissan Delivers A Versa Note To One Lucky Buyer In An Enormous Amazon Box Nissan Amazon Box New Cars

Chicago First-time Condo Buyers - Chicagoland First Time Home Buying Guide

The Top 10 Mistakes New Home Buyers Make - Moneysense

First Time Home Buyer Rrsp In Canada Using Your Rrsp Money

Best Time To Buy A Home Nextadvisor With Time

Homebuyers To Get New Mortgage Incentive Home Buyers Plan Boost Under 2019 Budget - National Globalnewsca

Pin On Sell Bitcoin Online For Cash

Reddit Has Now Disclosed That It Suffered A Data Breach In June And That Login Credentials Were Stol Lost Technology Best Social Media Sites Social Media Site

What Is The First-time Homebuyer Credit Credit Karma Tax

First Time Home Buyer Incentives Tips - Bmo

Intense Financial Advisor Website Template - Templatemonster Website Template Financial Website Responsive Website Template

Ttp Buffalobills Buffalo Bills Stuff Buffalo Bills Bills Football

Top Benefits Of Using A Real Estate Agent To Buy A House Zillow

First-time Homebuyer Heres What You Need To Know