Your profit would be $10, but if you were to buy more options, you would multiply your gains (or losses). The maximum gain would be if the stock were called away at 40.

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

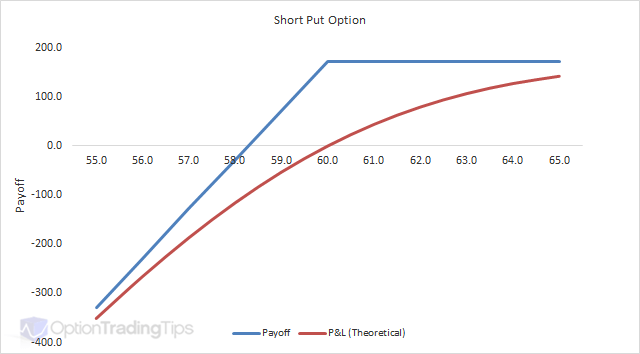

Short Put Definition

The formula for calculating loss is given below:

/dotdash_Final_Short_Put_Apr_2020-01-c4073b5f97b14c928f377948c05563ef.jpg)

Buy to open put max loss. So if it cost you $100 to buy the put that is as much as you can lose. If you’re used to buying 100 shares of stock per trade, sell one put contract (1 contract = 100 shares). Max loss = net premium paid + commissions paid;

Buy 100 shares of yhoo @ 49. Place a buy limit order. Following the 2 percent rule, you'll need to have $65,500 in.

The actual orders used would be “buy to open or “sell to open. Since you could have spent $29,100 buying 1,000 shares of tiffany & co. Max loss occurs when price of underlying >= strike price of long put;.

A general rule of thumb is this: Buy it or sell it. When selling puts with no intention of buying the stock, you want the puts you sell to expire worthless.

How to buy put options. In the example from chart 1 that amount is $44. This strategy has a low profit potential if the stock remains above strike a at expiration, but.

The maximum loss occurs if the underlying falls to zero and the put writer is assigned to buy the shares at $32.50. It's better than losing thousands of dollars if you were to purchase the stock and it fell in price. The maximum loss is partially offset by the premium received from selling the.

The maximum loss would be. Cost basis = 49 (if order is filled @ 49) option 2: So if the stock goes up in price your put will lose value.

Understanding buy to open orders X100 = $4,800) breakeven at expiration: To buy put options, you have to open an account with an options broker.

If the three months passes without the shares falling below $100, you would let the option expire without exercising it. The max you can lose with a put is the price you paid for it (that's a relief). Sell a put, strike price a.

Because of the put options you sold, you have a $40,000 total potential commitment to your put option buyer, minus $11,600 in cash received from him, equaling $28,400 remaining potential capital you'd need to come up with to cover the stock purchase price if the options are exercised. The phrase buy to open refers to a trader buying either a put or call option, while . Even if the stock rises to $55 or $100 a share, the put option holder will only lose the amount they paid to purchase the option.

If you’re comfortable buying 200 shares, sell two put contracts, and so on. The max loss is always the premium paid to own the option contract; 1) close it with an offsetting trade 2) let it expire worthless on expiration day or, 3) if you are long an option you can exercise it.

Advantages of buying put options. Sell a $49 strike put You could purchase one put option and sell it for $1,290 at the end of the day.

The formula for calculating maximum loss is given below: You would have spent $200 without gaining anything, but you will have insured yourself against losses. Trader wants to own 100 shares of yhoo if price goes down to $49.

Once you are long or short an option there are a number of things you can do to close the position: When you open an option position you have two choices: Yhoo current market price = 49.70.

If applicable, the covered put writer will also have to payout any dividends. Let’s put them to the top of the spreadsheet to cells l2 and l3. Selling the put obligates you to buy stock at strike price a if the option is assigned.

For a put writer, the maximum gain is limited to the premium collected, while the maximum loss would occur if the underlying stock price fell. There are several terms to know when executing these four basic trades. Keep enough cash on hand to buy the stock if the put is assigned.

In theory, maximum loss for the covered put options strategy is unlimited since there is no limit to how high the stock price can be at expiration. Short puts may be used as an alternative to placing buy limit orders. If g70highest</strong> strike and p/l at infinite underlying price equals negative infinite (which is also maximum possible loss of the entire position) now we have all the necessary information for the actual maximum profit and maximum loss formulas.

What Is The Maximum Loss In Options - Quora

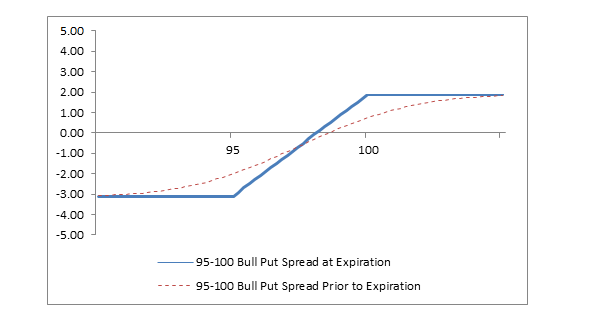

Bull Put Spread - Fidelity

Short Put Option

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Put Option Vs Call Option When To Sell

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

Stock Prices Plunging Should You Buy A Put

Bear Put Spread

Short Put Option Maximum Profit Loss Calculations On Short Put Option Options Futures Derivatives Commodity Trading

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Options Trading Strategies 4 Strategies For Beginners

Put Options Explained What They Are How They Work Ally

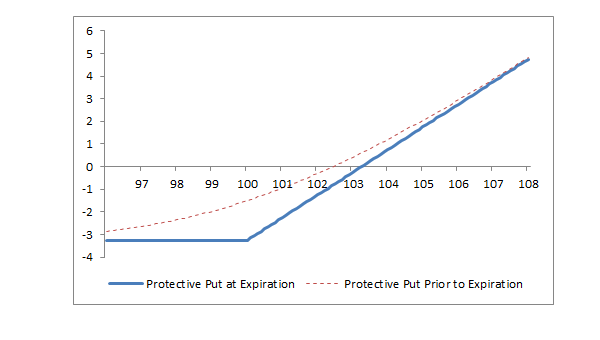

Protective Put Option Strategy - Fidelity

What Is The Maximum Loss In Options - Quora

Intro To Put Credit Spreads Roptions

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

Stock Prices Plunging Should You Buy A Put

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

Options Trading Strategies 4 Strategies For Beginners

Options Basics Protect Your Downside With Put Options By Market Monster Medium

Call And Put Options Cma

Short Put Option Explained Free Guide Trade Examples Projectoption

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Protective Put Definition

Put Options Under The Spotlight Benefits And The Danger Of Expiring Worthless - Commoditycom